So, you’re finally sitting down to review your insurance policy. Maybe it’s your auto insurance, life insurance, or even your home insurance—whatever the case, you’re about to embark on what is arguably one of the most confusing, frustrating, and borderline mind-numbing tasks known to humankind. It’s like deciphering an ancient text with a million footnotes, and yet, it’s something you absolutely need to do.

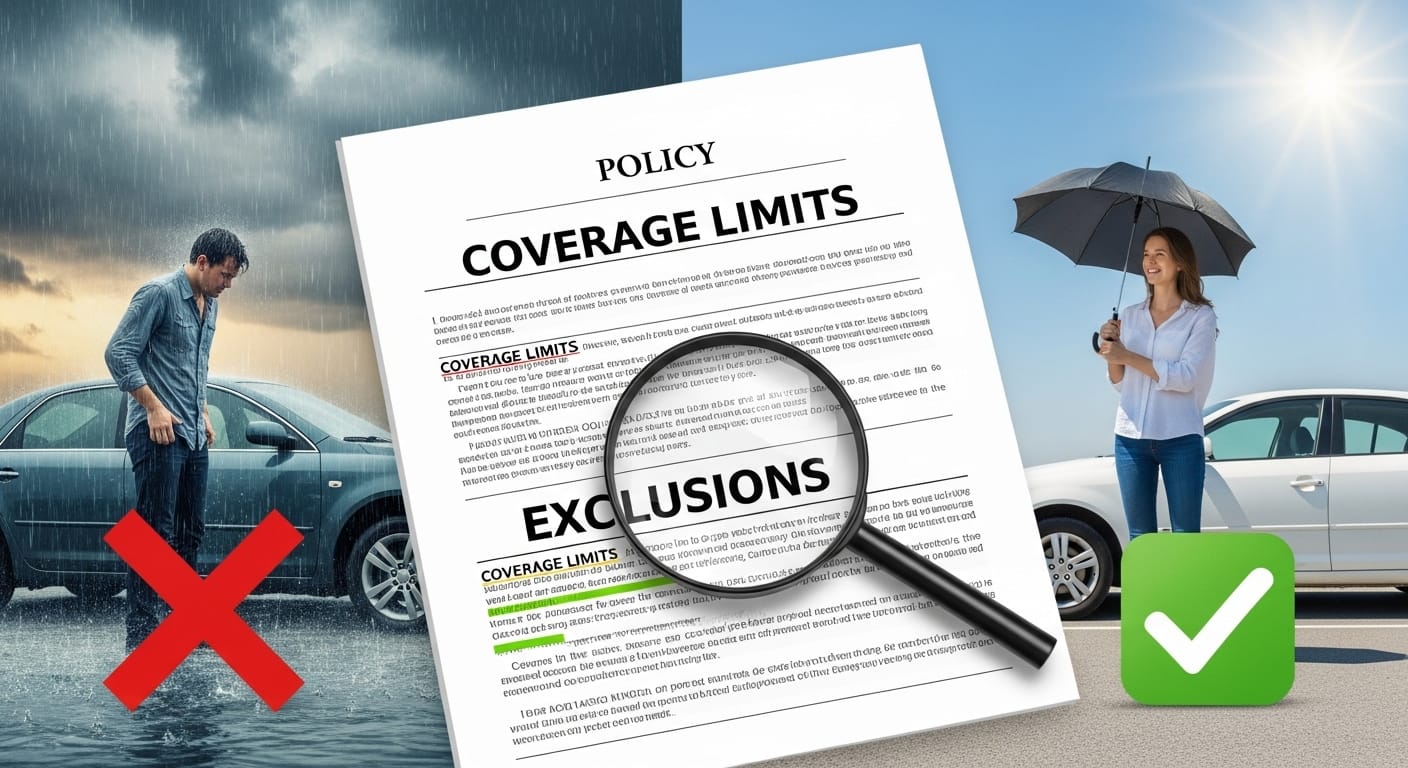

Now, let’s talk about the most critical aspects of your policy—the coverage limits and exclusions. These are the parts of the policy where you can go from feeling like you’ve got a solid safety net, to realizing that safety net has some rather large holes in it.

But fear not! With a little help from me (and maybe some coffee), you’ll walk away understanding exactly what you’re signing up for. Let’s dig in.

Top Takeaways and Key Concepts

Review your coverage limits to ensure your insurance can fully handle potential claims.

Examine exclusions carefully to avoid unexpected out-of-pocket expenses in specific situations.

Adjust coverage limits when life changes, like adding a driver or buying a home.

Understand the relationship between deductibles and coverage limits to manage costs effectively.

Know your options to challenge low coverage or unfair exclusions if claims are denied.

Summary of This Article

Please Note: This post may contain affiliate links. If you click one of them, we may receive a commission at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

The article explains the importance of understanding insurance coverage limits and exclusions. Coverage limits define the maximum payout, while exclusions outline what is not covered, both directly affecting claims. It emphasizes reviewing and adjusting coverage as life circumstances change and considering the impact of deductibles. The article also highlights the potential to challenge low coverage or unfair exclusions through documentation or legal assistance. Careful review and proactive management of policies help avoid unexpected financial burdens when filing claims.

What Is Coverage Limits Anyway?

Think of coverage limits like the ceiling of your insurance policy. They represent the maximum amount your insurance company will pay out if you make a claim. For example, if your auto insurance has a coverage limit of $100,000 for damages, that’s the most the insurer will pay out for any single incident.

You’ll want to pay attention to these limits because—surprise, surprise—they can vary widely depending on your policy.

Imagine you’re in a car accident and the total damage is $120,000. Now, if you’ve only got a coverage limit of $100,000, you’ll have to cover the remaining $20,000 out of your own pocket. Ouch. This is why it’s important to ensure that your coverage limits are high enough to cover potential incidents.

The Fine Print: What About Exclusions?

Now that we’ve covered the limits, let’s talk exclusions—basically, the sneaky clauses in your policy that say, “This is not covered, ever.” Exclusions are often buried in the fine print, and if you’re like most people, you probably skimmed right over them. But understanding these is critical. Exclusions can be deal-breakers if you’re depending on your insurance to cover a particular scenario.

For example, let’s say you’ve got homeowners insurance that covers fire damage. But wait—if the fire started from a neglected barbecue grill, your policy may exclude that situation. Or maybe your auto policy doesn’t cover damages if you were driving under the influence. Not reading through exclusions can leave you feeling blindsided when you make a claim.

How Coverage Limits Affect Your Claim

It’s important to understand that the coverage limits are directly tied to the amount you can claim. The higher your coverage limit, the more protection you’ll have. It sounds simple enough, but where it gets tricky is when you’ve got a claim that exceeds the limit. That’s when things can get dicey.

Let’s say you have medical insurance with a $50,000 limit on a specific treatment. If your hospital bills go beyond that, you’ll be responsible for the rest, even if your insurer initially made it seem like you were fully covered. Don’t get stuck in the trap of assuming your insurer will pay for everything. Read the fine print, check your limits, and know when you’re out of pocket.

The Dreaded “Not Covered” Clause

No one likes to see a “not covered” clause, and yet, there they are, lurking in most policies. These clauses outline the things that the policy won’t pay for. They can range from the mundane (like accidental damage to your own property) to the highly specific (like damage caused by earthquakes or floods if you don’t have specialized coverage).

Sometimes these exclusions are obvious, and sometimes they feel like an evil trick. For instance, your auto insurance may exclude any damages caused by driving in a race. Who knew that “driving like a maniac” wasn’t part of the standard policy? But hey, it’s better to know these things up front rather than be left with a massive bill later.

How to Determine If You Need to Adjust Your Coverage Limits

I think we can all agree that most people don’t even realize they can adjust their coverage limits. It’s one of those “set it and forget it” things that sounds good in theory but might not be appropriate over time.

Life changes, and so should your coverage. Have you added a new driver to your car insurance? Bought a home? Had a baby (who you absolutely want to protect)? All of these life events could mean it’s time to reassess your coverage limits.

But adjusting your limits isn’t as simple as just increasing them. It often comes with higher premiums. So, the trick is finding that sweet spot where you have enough coverage to handle major expenses, but not so much that you’re paying for a Lamborghini’s worth of insurance on your sedan.

The Impact of High Deductibles on Coverage Limits

Here’s a fun fact: your coverage limit and deductible are two sides of the same coin. If you’re opting for a low premium, chances are your deductible is going to be higher. The deductible is what you have to pay out-of-pocket before the insurance company steps in.

So, let’s say your auto insurance has a $1,000 deductible. If you total your car and the repair costs $10,000, you’ll be responsible for the first $1,000, and the insurance company will cover the remaining $9,000 (assuming your limits cover that amount).

Sometimes people think that a higher deductible is a good deal since it lowers premiums, but if you ever have to make a claim, you’ll quickly realize that paying that deductible can sting. Just be mindful of what you’re agreeing to when selecting a deductible.

When Exclusions Make You Wish You Had Read the Fine Print

Exclusions are tricky little things. Most of the time, you don’t know you’ve been affected by an exclusion until it’s too late. I mean, who really reads the full policy? The fine print can seem overwhelming, and most people assume that “common sense” will guide them. But, as we all know, insurance companies don’t run on common sense—they run on contracts.

So, when you’re reviewing your policy, ask yourself: “What’s not covered here?” Are there any exclusions that could come into play? What about a natural disaster, like a flood or hurricane? These types of exclusions can often be overlooked, leaving you high and dry when disaster strikes. It’s one of those situations where you don’t realize the importance until you’re already in deep.

Can You Challenge Coverage Limits and Exclusions?

Let’s say you’ve reviewed your policy, and it turns out your coverage limit is too low or an exclusion is standing in your way. Is there any recourse? Well, the short answer is yes, but it’s not always easy. Insurance companies love to keep things as cut-and-dry as possible. However, if you feel your claim was unfairly denied due to an exclusion or low coverage, you might be able to challenge it.

That said, challenging insurance decisions can be a lengthy process. You’ll likely need to provide ample documentation and sometimes even hire a lawyer to help you make your case. But don’t assume all is lost just because something wasn’t covered initially. There’s always room for negotiation, especially if you can prove that the exclusion doesn’t apply in your case.

Resources

Understanding Insurance Coverage and Exclusions

https://www.investopedia.com/articles/personal-finance/061516/understanding-insurance-coverage-and-exclusions.asp

How Coverage Limits Impact Your Policy

https://www.thebalance.com/understanding-insurance-coverage-limits-5188305

What to Know About Exclusions in Your Insurance Policy

https://www.consumerreports.org/cro/insurance/exclusions-insurance-policies

Frequently Asked Questions

What are coverage limits in an insurance policy?

Coverage limits represent the maximum amount your insurer will pay for a covered claim. Any costs exceeding this limit must be paid out-of-pocket by the policyholder.

What are exclusions in an insurance policy?

Exclusions are specific situations or damages your insurance policy does not cover. They define exceptions to coverage, such as certain natural disasters or intentional acts.

How do coverage limits affect my claim payout?

Your payout cannot exceed your coverage limit. If your claim amount is higher, you are responsible for the remaining balance beyond the insured amount.

Can I adjust my coverage limits over time?

Yes. You can increase or decrease coverage limits as your circumstances change, like buying property, adding family members, or acquiring valuable assets.

How do deductibles relate to coverage limits?

Deductibles are the amount you pay before insurance kicks in. Higher deductibles typically lower premiums but increase your financial responsibility in a claim.

Why is it important to review policy exclusions regularly?

Reviewing exclusions helps you identify gaps in coverage that could leave you unprotected during specific events or situations, such as floods or intentional damage.

Can I challenge a denied claim due to coverage limits or exclusions?

Yes. You can dispute denied claims by providing supporting documentation or consulting an attorney if you believe the insurer misapplied exclusions or limits unfairly.

Kevin Collier is a legal expert passionate about simplifying complex legal concepts for everyday individuals. With a focus on providing clear, practical information, he covers a wide range of topics, including rights, responsibilities, and legal procedures. Kevin aims to empower readers with the knowledge they need to navigate the legal landscape confidently, ensuring they can make informed decisions regarding their legal matters. Through insightful articles and easy-to-understand resources, he helps demystify the law, making it accessible to all.