Ah, love. That magical feeling that makes you believe your partner’s snoring is cute and that sharing a Netflix account is a lifetime commitment. But let’s face it: relationships, while beautiful, can also be messy. And if your love story takes an unexpected turn toward Splitsville, the financial fallout can make a rom-com plot look tame.

Enter the prenuptial agreement—a document that can save you from awkward post-breakup Venmo requests and, dare I say, financial chaos.

Despite its bad reputation as the ultimate romance buzzkill, a prenup is actually one of the smartest decisions you can make as a couple. It’s not about planning for divorce but rather preparing for the “what-ifs” in life. And really, isn’t that just being responsible adults? Let’s explore why prenups are more important than ever and how they might just be the unsung heroes of modern marriage.

Top Takeaways and Key Concepts

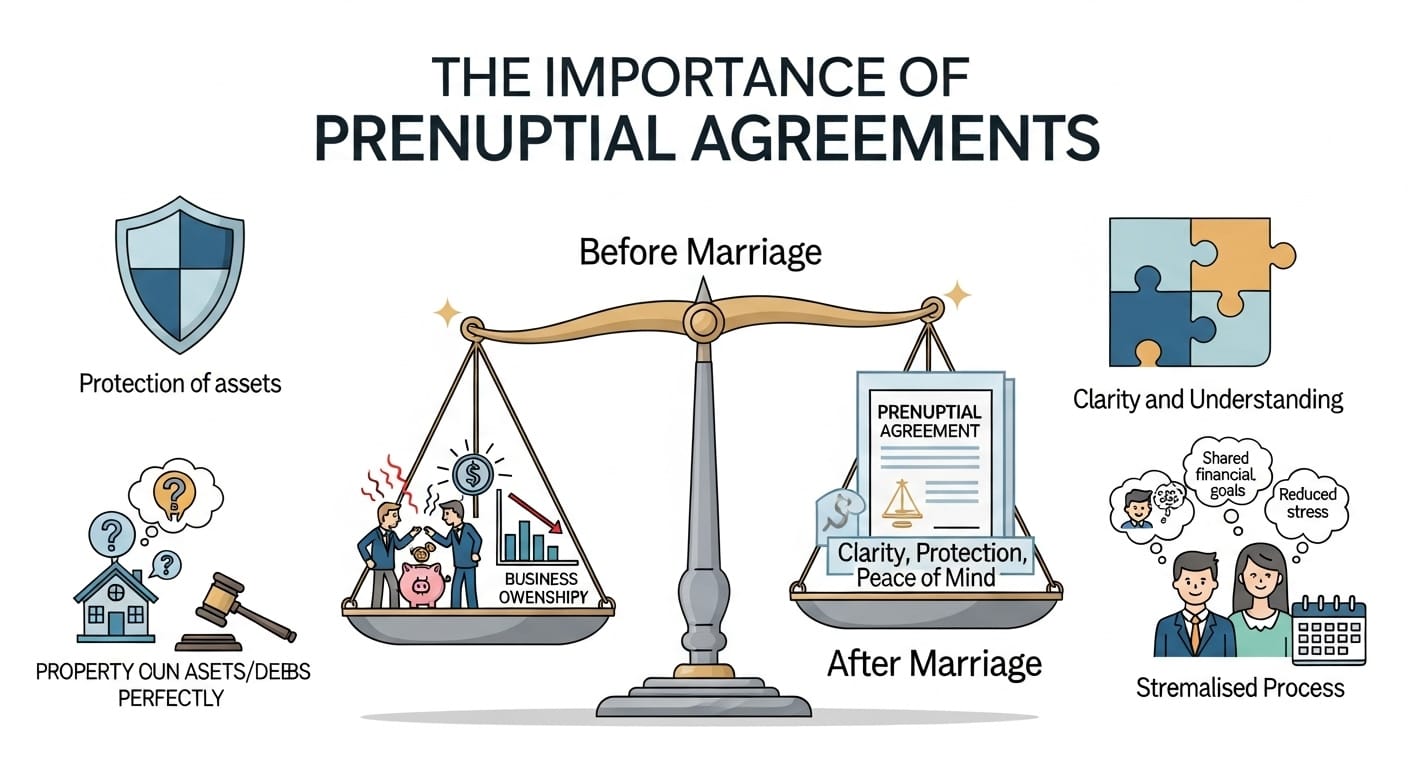

Set Clear Financial Expectations: Discuss assets, debts, and future earnings before marriage to prevent surprises later.

Protect Pre-Marital Assets: Ensure property, investments, or collections owned before marriage remain yours.

Shield Against Debt: Use a prenup to avoid being liable for your partner’s pre-existing debts.

Simplify Divorce Proceedings: Clearly outline financial arrangements to save time, money, and emotional stress if divorce occurs.

Encourage Open Communication: Prenups foster honest discussions about finances, inheritance, and business interests, strengthening the relationship.

Summary of This Article

Please Note: This post may contain affiliate links. If you click one of them, we may receive a commission at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

The article emphasizes the importance of prenuptial agreements in modern marriages as tools for financial clarity, asset protection, and relationship communication. Prenups help couples set expectations, safeguard pre-marital assets, shield against debts, and simplify potential divorce proceedings. They also protect family heirlooms, business interests, and encourage transparent discussions about finances. By challenging stereotypes that prenups are only for the wealthy, the article highlights their value for anyone seeking fairness, financial security, and peace of mind in marriage.

Setting Financial Expectations

Here’s the deal: money is one of the leading causes of stress in relationships. It’s right up there with forgetting anniversaries and leaving dirty socks on the couch. A prenuptial agreement is a way to put all the financial cards on the table before the wedding cake is even cut.

In many cases, couples don’t talk about their finances until it’s too late. By creating a prenup, you can outline who owns what and how future earnings or debts will be divided. Speaking of which, wouldn’t you rather have that conversation over coffee now than during a courtroom showdown later?

Protecting Pre-Marital Assets

If you’re walking into marriage with significant assets, like a house, a thriving business, or a collection of antique spoons, a prenup is your best friend. It ensures that what’s yours before the marriage stays yours, even if things go south.

Interestingly enough, some people think this makes marriage less romantic. But to be fair, is there anything romantic about fighting over a condo or a vintage car in court? By safeguarding your pre-marital assets, you’re simply acknowledging that life—and love—can be unpredictable.

Avoiding Debt Drama

Let’s flip the script for a moment. What if it’s not assets but debt that’s coming into the marriage? Maybe your partner has student loans the size of a small mortgage or a credit card balance that could rival the national debt. A prenup can protect you from being legally responsible for debts that aren’t yours.

On the other hand, having this conversation can also help you both develop a strategy for managing debt as a team. And really, isn’t teamwork the foundation of any good marriage?

Simplifying Divorce Proceedings

No one gets married planning for divorce (unless you’re a reality TV star, in which case, who knows?). But if it does happen, having a prenup in place can make the process less painful.

Instead of battling it out over who gets the houseplants or the dog, a prenup provides clear guidelines. This can save time, money, and a whole lot of emotional energy. By the way, it also means fewer billable hours for your lawyer—which is always a win in my book.

Protecting Family Heirlooms and Inheritances

If you’ve got family heirlooms or an inheritance waiting in the wings, a prenup is essential. Imagine the horror of losing Grandma’s antique wedding ring in a divorce settlement. A prenup ensures these sentimental treasures stay in the family, where they belong.

To be fair, this is also a great way to avoid awkward conversations with relatives who might otherwise side-eye your spouse during Thanksgiving dinner.

Supporting Business Interests

If one or both partners own a business, a prenup can protect those interests. Without one, your business could become entangled in a divorce settlement, potentially jeopardizing its future.

Interestingly enough, this isn’t just about money. It’s about preserving the hard work and effort you’ve put into building something meaningful. And really, wouldn’t you rather focus on growing your business than worrying about legal battles?

Encouraging Open Communication

At its core, a prenup is a tool for communication. It forces couples to discuss uncomfortable but important topics, from financial goals to potential deal-breakers.

On the other hand, having these conversations upfront can strengthen your relationship. It’s like relationship boot camp, but with fewer push-ups and more paperwork.

Challenging Prenup Stereotypes

Let’s address the elephant in the room: some people think prenups are only for the rich and famous. But that’s not true. Prenups are for anyone who wants to protect their financial future and ensure fairness in their marriage.

By normalizing prenups, we can help couples feel empowered to take control of their finances—without feeling like they’re dooming their love story.

Resources

American Academy of Matrimonial Lawyers – Prenuptial Agreements

https://www.aaml.org

LegalZoom – Prenuptial Agreement Basics

https://www.legalzoom.com

Nolo – How to Create a Prenuptial Agreement

https://www.nolo.com

Frequently Asked Questions

What is a prenuptial agreement?

A prenuptial agreement, or prenup, is a legal contract created before marriage that outlines how assets, debts, and financial responsibilities will be handled if the marriage ends.

Why is a prenuptial agreement important?

A prenup helps protect pre-marital assets, prevent disputes over finances, and ensure clarity about ownership and debt responsibilities, offering peace of mind for both partners.

Who should consider getting a prenup?

Anyone entering marriage with personal assets, property, business interests, or debt should consider a prenup to protect their financial interests and establish clear expectations.

Can a prenup protect against a partner’s debt?

Yes, a prenuptial agreement can specify that each spouse remains responsible for their individual debts, preventing one partner from being liable for the other’s financial obligations.

Does having a prenup mean planning for divorce?

No, a prenup isn’t about expecting divorce—it’s about planning responsibly for life’s uncertainties, similar to having insurance or an emergency fund.

Can a prenup include family heirlooms or inheritances?

Yes, a prenup can protect family heirlooms and future inheritances by ensuring these items remain separate property and are not subject to division during a divorce.

How does a prenup affect communication in a relationship?

Creating a prenup encourages open discussions about finances, goals, and expectations, which can strengthen trust and transparency between partners before marriage.

Kevin Collier is a legal expert passionate about simplifying complex legal concepts for everyday individuals. With a focus on providing clear, practical information, he covers a wide range of topics, including rights, responsibilities, and legal procedures. Kevin aims to empower readers with the knowledge they need to navigate the legal landscape confidently, ensuring they can make informed decisions regarding their legal matters. Through insightful articles and easy-to-understand resources, he helps demystify the law, making it accessible to all.