Insurance companies are like that friend who always promises to help you move but mysteriously disappears when it’s time to lift the couch.

You think they’re there for you, but once an accident happens, their true colors might shine through in ways you never expected.

Let’s dive into how these companies can impact your compensation and what you need to know to avoid getting stuck with a bill larger than your last pizza order.

Top Takeaways and Key Concepts

Understand Your Policy Thoroughly: Read all terms, coverage limits, exclusions, and deductibles before filing a claim.

Document Everything: Keep receipts, photos, and records organized to support your claim effectively.

Research Comparable Cases: Know what similar claims received to strengthen your negotiation position.

Negotiate Strategically: Use facts, avoid emotional arguments, and counter low offers with evidence.

Consider Legal Representation: Hire a specialized lawyer if claims are complex or insurer undervalues damages.

Summary of This Article

Please Note: This post may contain affiliate links. If you click one of them, we may receive a commission at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

The article explains how insurance companies can affect your compensation and how to navigate the claims process. It emphasizes the importance of thoroughly understanding your policy, documenting evidence, and staying organized when filing a claim. Key strategies include researching comparable cases, negotiating logically, and recognizing the role of adjusters who aim to minimize payouts. For complex situations, hiring an experienced attorney ensures proper advocacy and maximizes your potential settlement. Overall, patience, preparation, and strategic planning are crucial for achieving fair compensation.

Understanding Your Policy: The Fine Print Maze

So, here’s the deal: insurance policies can be more confusing than trying to read a novel while riding a roller coaster. When I first cracked open my policy, I felt like I was deciphering an ancient scroll written in a language only known by cryptographers.

What does “exclusion” even mean? It sounds like something that happens at a middle school dance!

Understanding your policy is crucial because not all coverage is created equal. Some policies will cover every little thing under the sun—like if your cat knocks over your grandmother’s antique vase during an epic game of chase—but others will leave you high and dry when you really need them.

And then there are deductibles, which are basically insurance jargon for “the amount of money we’ll make sure you pay before we help.” If your deductible is higher than the cost of fixing your car after an accident, well… congratulations! You just won the lottery of disappointment.

Filing a Claim: A Journey Through Paperwork Hell

When it comes time to file a claim, prepare yourself for what feels like entering paperwork hell. Honestly, filing a claim can sometimes feel like trying to get through airport security—lots of waiting, lots of forms, and occasionally wanting to scream at someone behind the counter.

First off, keep all those receipts! You might think they’re useless bits of paper cluttering up your wallet until the moment arrives when they become your golden tickets to compensation city.

And speaking of receipts, don’t forget about photos! If something has gone wrong—a fender bender or worse—snap some pictures as evidence; otherwise, it’s just your word against theirs.

Interestingly enough, many people give up halfway through this process because it gets too tedious or overwhelming. But here’s a tip: stay organized! Create folders (real or digital) where you keep everything related to your claim so that when they ask for proof that Aunt Sally was present during the incident (yes, they might), you’re ready!

Negotiation Tactics: Channeling Your Inner Lawyer

Once you’ve submitted that mountain of paperwork and received an offer from the insurance company—which often resembles Monopoly money—you’ll want to negotiate. Think about this as playing poker with someone who thinks they’re holding all aces but actually has nothing but twos and threes.

Now let me tell you something important: knowing what you’re entitled to makes all the difference! Do some research on similar cases in your area so when they throw out some ridiculously low number (because why not?), you’ll have facts on hand instead of just hoping for sympathy points.

By the way, don’t let emotions cloud your judgment during negotiations; it’s easy to get frustrated when dealing with adjusters who seem more interested in sipping coffee than helping you out. Stick with logic and facts—it’s much harder for them to argue against numbers than feelings!

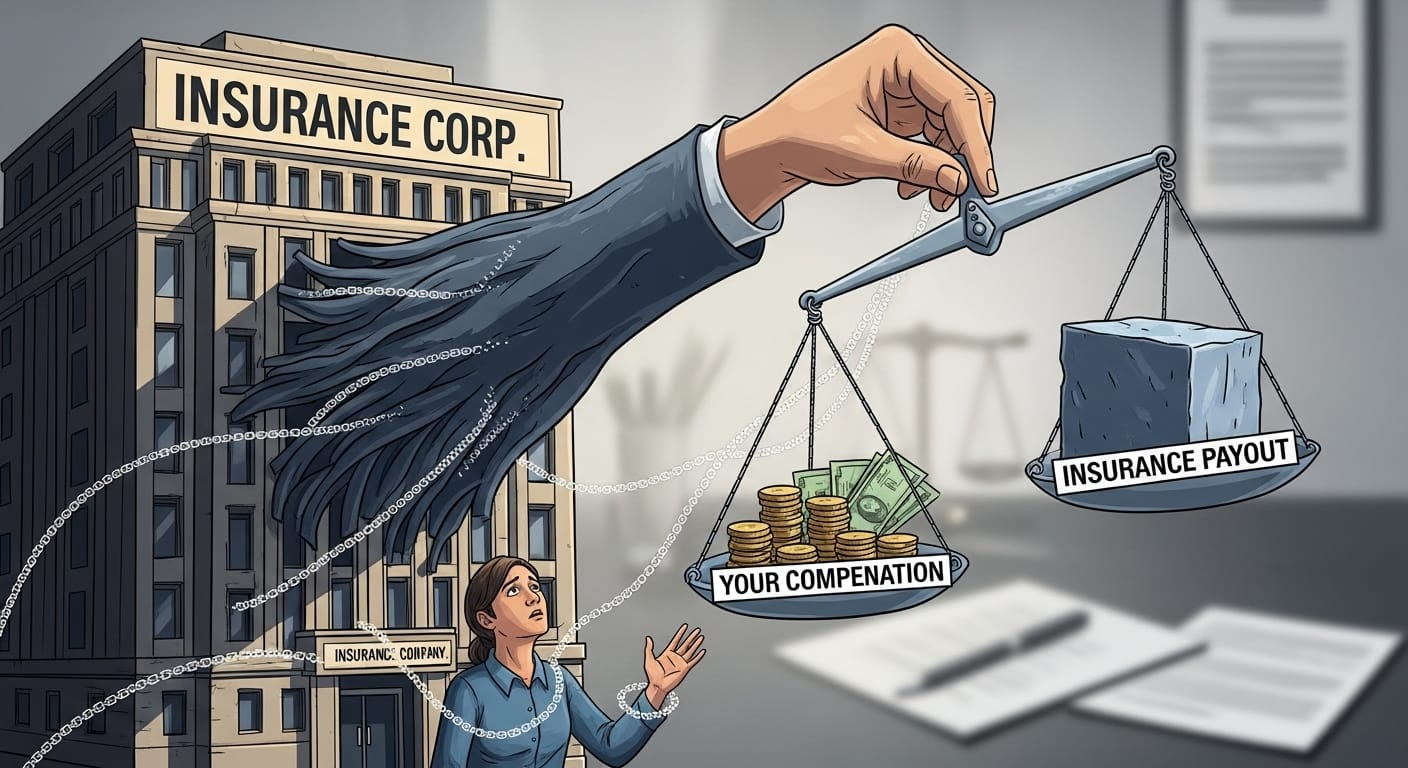

The Role of Adjusters: Allies or Adversaries?

Insurance adjusters often walk into our lives looking friendly enough—like puppies eager for treats—but remember: they work for the insurance company! Their job is essentially one big balancing act between keeping costs down for their employer while also addressing claims fairly.

Adjusters evaluate claims based on various factors including damages and liability—and guess what? They may try hard to minimize payouts by questioning everything from how fast you were driving (even if it was 10 mph) to whether or not that dent in your bumper was really caused by this incident or perhaps by years’ worth of grocery store parking lot adventures.

Here’s where understanding how adjusters operate becomes essential; knowledge truly is power! They may use tactics designed specifically around reducing payout amounts. So being prepared means knowing what information they’ll likely request ahead of time—this could save both time and frustration later on!

The Influence of Legal Representation: When To Call In Backup

Sometimes navigating through insurance claims feels akin to wandering through a dense jungle without GPS—and that’s when having legal representation can be invaluable! Lawyers understand not only how insurance companies operate but also how best to advocate for maximum compensation on behalf of their clients.

But here’s my advice: choose wisely! Not every lawyer specializes in personal injury cases or has experience dealing with specific insurers’ tactics. You wouldn’t want someone representing you who thinks “liability” refers solely to their bad cooking skills at family gatherings!

Having legal backup means less stress for you while ensuring someone knowledgeable handles negotiations effectively—not unlike having a seasoned coach guiding players during championship games!

Conclusion: Know Your Worth

In conclusion, understanding how insurance companies impact compensation isn’t just useful—it’s vital! From reading policies carefully (even though it feels tedious) all the way through negotiations with adjusters armed with solid facts about similar cases—the journey toward fair compensation requires patience mixed with strategic planning.

Remember this key point: knowledge empowers consumers against potential pitfalls lurking within fine print clauses designed primarily benefiting insurers rather than individuals seeking justice post-incident!

Suggested Resources:

How Insurance Companies Determine Payouts

https://www.nolo.com/legal-encyclopedia/how-insurance-companies-determine-payouts.html

The Claims Process Explained

https://www.investopedia.com/articles/pf/061215/claims-process-explained.asp

Negotiating With Insurance Adjusters

https://www.thebalance.com/negotiate-with-an-insurance-adjuster-4171456

Frequently Asked Questions

How do insurance companies affect my compensation after an accident?

Insurance companies often aim to minimize payouts, meaning their assessments and settlement offers may not fully reflect your actual damages or losses.

Why is it important to understand my insurance policy?

Knowing your coverage limits, exclusions, and deductibles helps prevent surprises and ensures you know what compensation you’re truly entitled to.

What documents should I keep when filing a claim?

Keep all receipts, photos, medical bills, and written communication related to the incident to support your claim and speed up the review process.

How can I negotiate a better settlement with an insurance company?

Base negotiations on evidence and comparable case outcomes, stay calm, and avoid emotional arguments to strengthen your position and secure a fair offer.

What does an insurance adjuster do?

An adjuster evaluates your claim for the insurance company, determining damages and liability, often with the goal of reducing payout amounts.

When should I hire a lawyer to deal with my insurance claim?

If your claim is complex, undervalued, or being delayed, hiring a personal injury attorney ensures fair representation and maximizes your compensation.

How can I protect myself from unfair insurance practices?

Stay organized, document every interaction, research similar cases, and seek legal advice if you suspect the insurer is acting in bad faith.

Kevin Collier is a legal expert passionate about simplifying complex legal concepts for everyday individuals. With a focus on providing clear, practical information, he covers a wide range of topics, including rights, responsibilities, and legal procedures. Kevin aims to empower readers with the knowledge they need to navigate the legal landscape confidently, ensuring they can make informed decisions regarding their legal matters. Through insightful articles and easy-to-understand resources, he helps demystify the law, making it accessible to all.