So, you’ve heard about small claims court—maybe you’ve seen it in TV shows or movies where it looks like a quick way to settle disputes without needing to hire fancy lawyers. And while it might not be as dramatic as a courtroom scene from “Law & Order,” small claims court is where everyday people go to settle everyday issues.

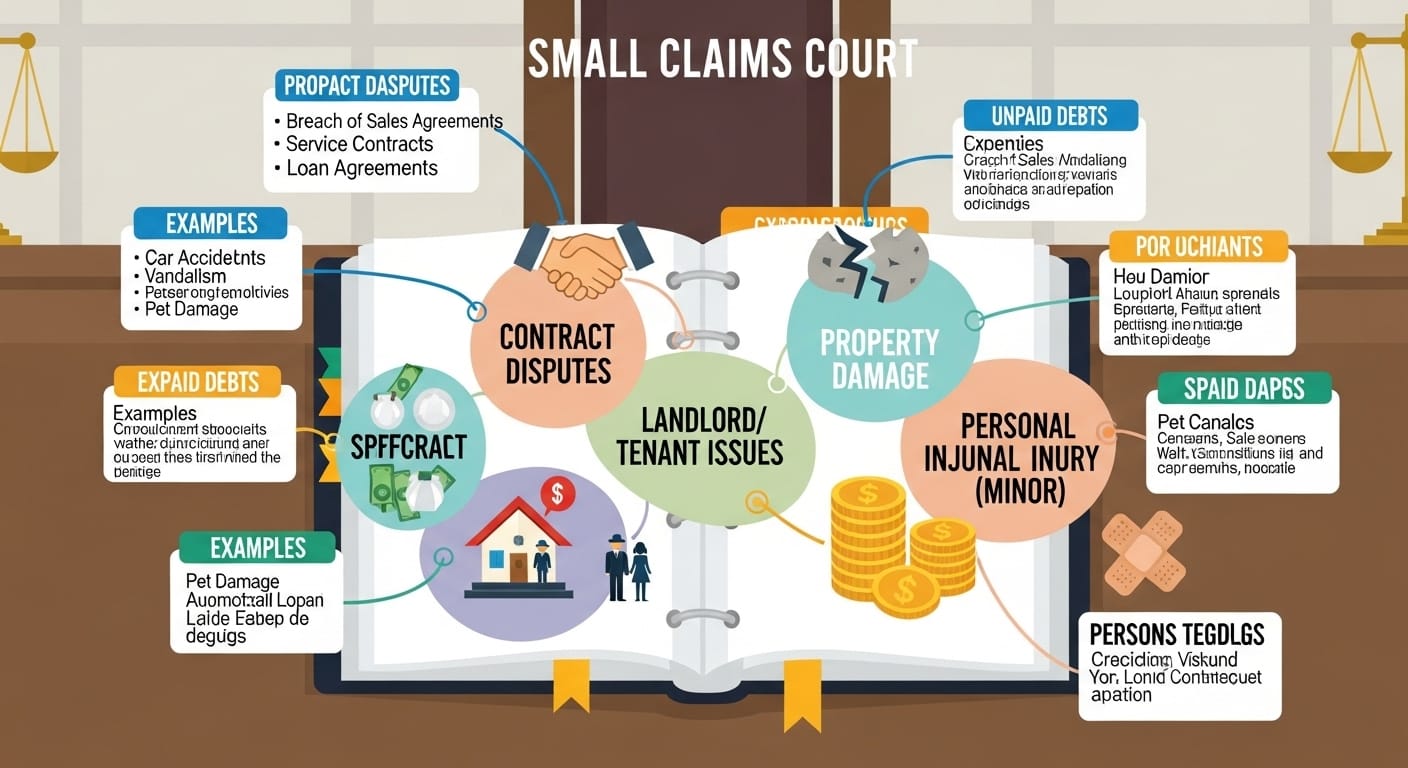

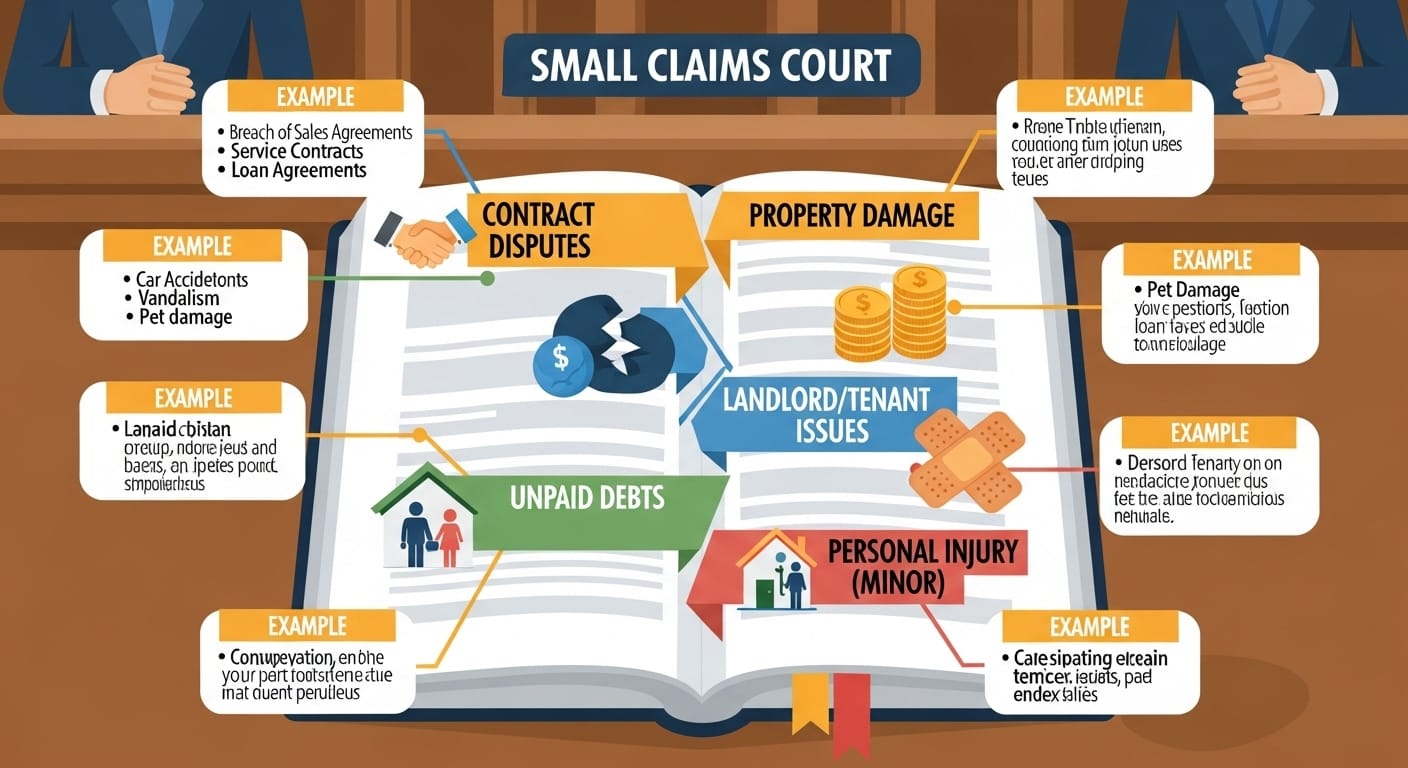

If you’re considering filing a claim, you might be wondering, “What kinds of cases are typically handled in small claims court?” Well, let’s dive in and take a look at some of the most common types of cases that pop up in this court.

Top Takeaways and Key Concepts

File for Unpaid Debts: Keep contracts, receipts, or texts to prove money is owed within court limits.

Document Property Damage: Collect photos, repair bills, and witness statements to support compensation claims.

Prove Breach of Contract: Show a valid agreement, broken terms, and resulting harm with clear evidence.

Resolve Landlord-Tenant Disputes: Use lease agreements, communications, and property photos to claim deposits or unpaid rent.

Claim Consumer or Employment Rights: Gather receipts, warranties, timesheets, and emails to recover defective products or unpaid wages.

Summary of This Article

The article explains the common types of cases handled in small claims court, including unpaid debts, property damage, breach of contract, landlord-tenant disputes, consumer complaints, employment disputes, and unreturned deposits. It emphasizes the importance of gathering clear, organized evidence such as contracts, receipts, photos, and communications to support claims. Small claims court allows individuals to resolve everyday disputes without high legal costs, provided they can prove their case effectively. Preparing documentation carefully and understanding the court’s requirements increases the likelihood of winning and obtaining compensation.

Unpaid Debts: The “I Owe You” Cases

First up, let’s talk about the bread and butter of small claims court: unpaid debts. These cases typically involve someone who owes money for services rendered, goods sold, or loans given. Maybe you did a favor for someone, lent them money, or provided a service, and now they’re avoiding you like the plague when it’s time to pay up. What do you do? Well, if you’re tired of chasing them around for payment, small claims court could be your solution.

Let’s see—if you’ve ever lent money to a friend who promised to pay you back “next week” (and somehow that week has turned into months), you know how frustrating this can be. The court allows you to file a claim for unpaid debts, as long as the amount is within the limit set by your local small claims court.

Now, the trick is proving that the debt exists, so keep any receipts, contracts, or texts that mention the debt. The more evidence you have, the better your chances of winning.

Property Damage Claims: When Someone Dents Your Car

Next, let’s talk about property damage. This type of case might seem straightforward—someone damages your property, and you want them to pay for the repairs. Whether it’s a dent in your car, a broken window, or even damage to your fence, if someone’s negligence led to property damage, you could take them to small claims court to get compensation.

If you’ve ever had your car hit by another vehicle and the driver doesn’t own up to it, you know how infuriating it can be. But what do you do? You file a claim in small claims court, of course! In these cases, you’ll need to show proof that the defendant was responsible for the damage. Photographs, repair bills, and witness statements are all useful evidence. The court will then determine whether the defendant should pay for the repairs.

Breach of Contract: When the Deal Goes Sour

Now, here’s a classic one: breach of contract cases. Imagine you entered into a contract for a service—say, you hired someone to remodel your bathroom, and after receiving a hefty deposit, they vanish into thin air (or worse, leave you with a half-done job). Well, in small claims court, you can file a claim against them for failing to fulfill the terms of the contract.

These cases can get a little tricky, though. After all, what does “breach of contract” actually mean? It means one party failed to do what they agreed to do. So, you’ll need to prove that a valid contract existed, that the terms were broken, and that you suffered harm because of it. Keep in mind that having a signed agreement, a clear timeline of what was promised, and a record of communications with the defendant can really strengthen your case.

Landlord-Tenant Disputes: The Classic Showdown

Landlord-tenant disputes are also common in small claims court. These cases can range from disagreements about security deposits to rent payments that were never returned. For example, maybe you’re a tenant who paid a security deposit, but when it came time for your landlord to return it after you moved out, they conveniently “forgot” to send it back. What do you do? That’s right—time to head to small claims court!

Landlord-tenant cases often revolve around lease agreements and the condition of the rental property. Tenants can sue for the return of their security deposit, while landlords can file claims for unpaid rent or property damage caused by tenants. If you’re the one filing, you’ll want to have a copy of the lease, any communications with your landlord, and photographs of the property to support your claim.

Consumer Protection Claims: The Defective Product Nightmare

Imagine you bought a shiny new gadget, only to find out that it’s defective. Or maybe a company promised a product or service that didn’t live up to expectations. These types of cases, known as consumer protection claims, are a common sight in small claims court. Consumers file these claims to get refunds or compensation for faulty products or poor services.

Let’s be real—if you’ve ever purchased something online only to find out it doesn’t work as promised, you probably wanted to scream. But before you do, it’s important to first contact the seller and try to resolve the issue.

If that doesn’t work, small claims court might be the next step. In these cases, make sure you have all the receipts, warranties, and proof that the product didn’t meet the advertised standards. The more evidence you provide, the easier it will be for the judge to rule in your favor.

Employment Disputes: The Missing Paycheck

Employment disputes are another category that makes its way to small claims court. These disputes can range from unpaid wages to wrongful termination claims. If your employer failed to pay you for hours worked, you can file a claim in small claims court to recover your lost wages.

These cases often revolve around employment contracts, timecards, and payment records. If you’ve been wronged in the workplace, it’s important to document everything—timesheets, emails, and other communications will be your best friends here. A well-documented case increases your chances of success and might just result in the compensation you deserve.

Unreturned Deposits: When Your Refund is Nowhere to Be Found

Deposits—ah, yes, they can be a source of much frustration. Whether you paid a deposit for an apartment, event venue, or rental service, getting that deposit back can sometimes feel like chasing a unicorn. If the other party refuses to return your deposit without a valid reason, small claims court might be your best option.

These cases are typically straightforward—if you have a contract or agreement stating that your deposit should be refunded and the other party refuses, you can file a claim. Make sure to gather your deposit receipts, any communications with the defendant, and a copy of the agreement. If the defendant can’t prove they were justified in keeping your deposit, the court will likely rule in your favor.

Resources

How Small Claims Court Works

https://www.nolo.com/legal-encyclopedia/how-small-claims-court-works

What to Expect in Small Claims Court

https://www.lawhelp.org/us/resource/what-to-expect-in-small-claims-court

Common Small Claims Cases and How to Win Them

https://www.legalzoom.com/articles/common-small-claims-cases-and-how-to-win-them

Frequently Asked Questions

What types of cases are commonly filed in small claims court?

Common cases include unpaid debts, property damage, breach of contract, landlord-tenant disputes, consumer complaints, employment issues, and unreturned deposits.

Can I file a claim for unpaid debts in small claims court?

Yes. You can file for unpaid debts if someone owes you money for services, goods, or loans, as long as the amount is within your local court’s monetary limit.

What evidence do I need for a property damage claim?

Provide photos, repair bills, and witness statements that clearly show who caused the damage and the cost required to fix or replace the property.

How can I prove a breach of contract in small claims court?

Show that a valid contract existed, that one party failed to meet its terms, and that you suffered measurable loss or harm as a direct result.

What landlord-tenant issues can be resolved in small claims court?

Common cases include disputes over unpaid rent, withheld security deposits, or property damage, supported by leases, receipts, and photographs.

Can I sue for defective products or poor service?

Yes. Consumer protection cases allow you to claim refunds or damages for faulty products or unsatisfactory services if you have receipts and proof of defects.

What should I bring to court for an employment or deposit dispute?

Bring contracts, payment records, communication logs, and any proof showing unpaid wages or that a deposit was wrongfully withheld by the other party.

Kevin Collier is a legal expert passionate about simplifying complex legal concepts for everyday individuals. With a focus on providing clear, practical information, he covers a wide range of topics, including rights, responsibilities, and legal procedures. Kevin aims to empower readers with the knowledge they need to navigate the legal landscape confidently, ensuring they can make informed decisions regarding their legal matters. Through insightful articles and easy-to-understand resources, he helps demystify the law, making it accessible to all.