Insurance claims—let’s be honest, nobody gets excited about them. It’s kind of like when your car breaks down in the middle of nowhere, and the first thing you do is pull out your phone only to realize you’re in a dead zone.

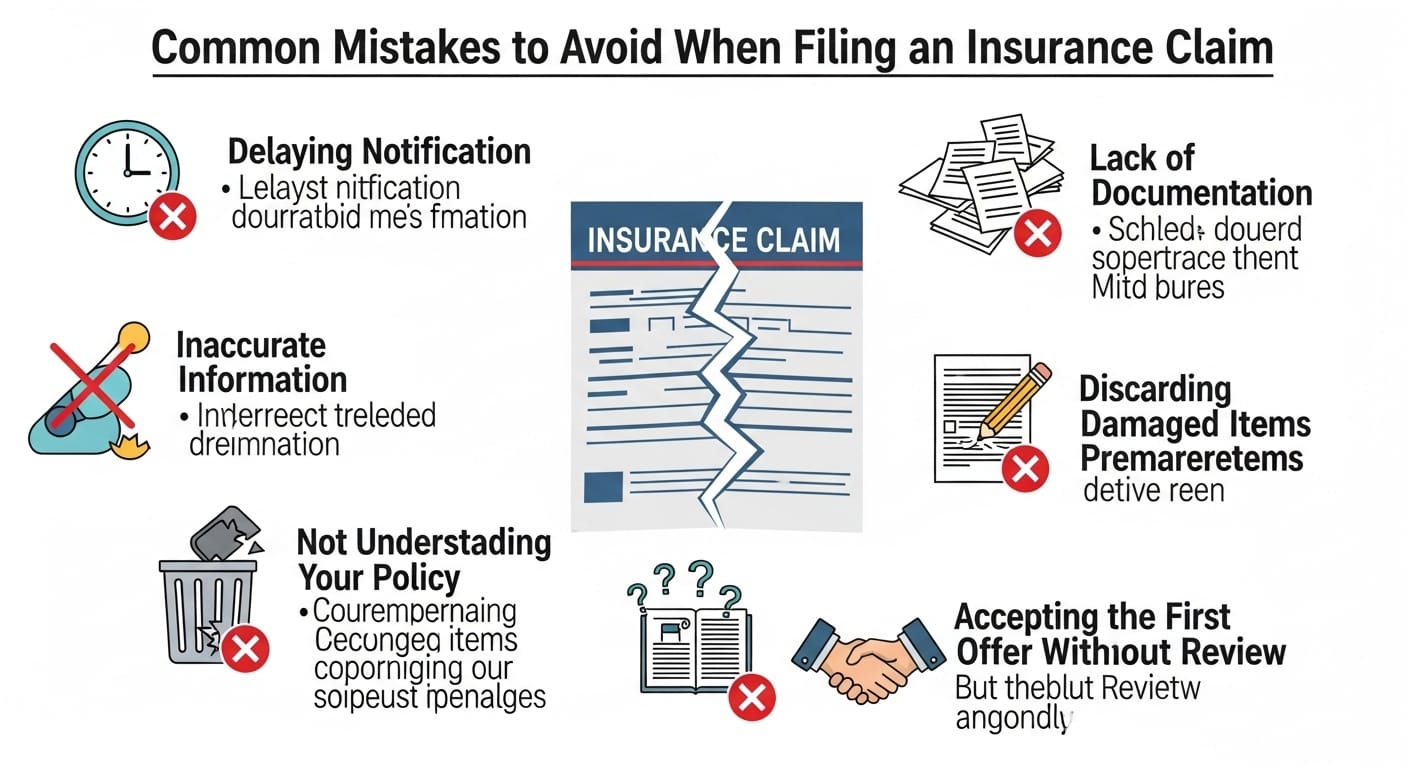

Filing an insurance claim should be straightforward, but there’s always that potential for disaster, and trust me, you don’t want to make mistakes along the way. Some errors could end up costing you a lot of time, money, and energy, while others might just leave you shaking your head and wondering if you missed an important step.

So, how can you avoid the biggest pitfalls? Well, let’s dive in.

Top Takeaways and Key Concepts

Read Your Policy Thoroughly: Understand coverage, exclusions, and deadlines before filing any claim.

Document Everything: Collect photos, receipts, and witness information to support your claim.

File Promptly: Submit claims as soon as possible to meet policy deadlines and avoid denial.

Follow the Process and Follow Up: Know required steps and regularly check claim status.

Be Honest and Keep Records: Never exaggerate; confirm all instructions and agreements in writing.

Summary of This Article

Please Note: This post may contain affiliate links. If you click one of them, we may receive a commission at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

The article outlines common mistakes when filing insurance claims and how to avoid them. Key advice includes thoroughly reading your policy to understand coverage and exclusions, documenting all relevant details of incidents, filing claims promptly, and following the insurer’s specific claims process. Staying proactive by regularly following up ensures your claim doesn’t get overlooked. Honesty is emphasized, as exaggerating or relying on verbal promises can lead to denial or legal consequences. Overall, careful preparation, clear records, and consistent communication increase the likelihood of a successful insurance claim.

Not Understanding Your Policy Before Filing

It’s easy to assume that you know everything about your insurance policy, right? After all, you’ve had it for years, and you’ve probably glossed over the terms while sipping coffee. But here’s the thing—insurance policies can be sneaky.

They love to hide exclusions and fine print, and if you don’t read it thoroughly, you might end up wasting your time and energy. If you think you’re covered for “all accidents,” but the policy says something like “excluding incidents caused by pre-existing conditions,” then surprise! You may not be as covered as you thought.

Before filing your claim, take the time to go through your policy with a fine-tooth comb. If there’s anything that seems unclear, don’t just assume it’s covered. And don’t hesitate to reach out to the insurance company for clarification. The last thing you want is to submit a claim only to have it denied for something you could have easily avoided.

Failing to Document Everything

One of the most common—and most avoidable—mistakes people make when filing an insurance claim is not documenting everything. Picture this: you’re in an accident, and in the chaos, you forget to take pictures, jot down details, or gather witness information. You may think you’ll remember it later, but guess what? You won’t. The insurance company isn’t going to take your word for it—they want proof.

If you’re involved in an accident or incident, make sure to document the scene, including photos of the damage, the environment, and anything else that might be relevant. Don’t forget about getting the contact info of witnesses too.

Trust me, this step will pay off when the time comes to prove your case. Without it, you might as well be trying to convince someone you saw Bigfoot—except without the proof.

Waiting Too Long to File the Claim

You know that moment when you keep putting things off, thinking you’ll “get to it later”? Well, insurance companies don’t like that. Filing your claim late is one of the easiest ways to sabotage yourself. Policies typically have strict deadlines for filing claims, and if you wait too long, you might as well kiss your payout goodbye.

Different policies have different timeframes, so be sure to check the deadline on yours. The sooner you file after the incident, the better. Some insurance companies allow a few weeks, while others might give you just a few days. So, don’t procrastinate—time is of the essence, especially when you’re dealing with a company that’s notorious for dragging its feet.

Misunderstanding the Claims Process

Ah, the insurance claims process. It’s kind of like trying to assemble Ikea furniture—looks simple until you realize there’s no instruction manual, and you’re just left with a pile of confusion and frustration. Every insurance company has its own process, and if you don’t understand it, things could get tricky.

Before you start the claim process, take the time to ask questions. Do they want you to submit forms online? Should you call them first? What documents do they need from you? Getting answers to these questions will help avoid unnecessary delays or missed steps. If you’re unclear about anything, don’t be afraid to ask for clarification. It’s better to ask questions upfront than to scramble later.

Not Following Up on Your Claim

So, you’ve filed your claim, and now you wait. But don’t make the mistake of assuming that everything will just work itself out. Insurance companies have a reputation for moving slowly, and sometimes, your claim can slip through the cracks if you don’t follow up.

Imagine you’re waiting for a package, and it’s been sitting at the post office for weeks—you’d call, right? Same deal with insurance claims.

Make sure to check in regularly with the insurance company. Keep track of your claim number, the people you speak to, and any updates they provide. This will help ensure that things don’t get lost in the shuffle. And let’s face it, sometimes you have to be a bit persistent to get the ball rolling. If they’re dragging their feet, politely nudge them forward.

Lying or Exaggerating the Claim

It may seem like an easy shortcut, but lying or exaggerating details in your claim is a surefire way to get yourself into hot water. Sure, you could embellish a few details to make things sound worse than they were, but insurance companies are smarter than that.

They’ll investigate your claim, and if they catch you in a lie, not only will your claim be denied, but you could also face criminal charges. No amount of insurance money is worth that kind of risk.

Instead of stretching the truth, focus on presenting the facts clearly and honestly. Remember, truth is always the best policy (pun intended). If something didn’t happen the way you thought it did, that’s fine—just make sure the insurance company knows exactly what occurred, and they’ll handle the rest.

Relying on Verbal Agreements

Insurance companies are known for their paperwork, and for good reason—it’s the proof you need. So, don’t fall into the trap of relying on verbal agreements. You might speak with an agent who seems friendly and promises that your claim will be handled, but unless that promise is in writing, it’s about as reliable as a paper towel in a rainstorm.

Get everything in writing, from claim numbers to instructions. If an agent tells you something over the phone, follow up with an email to confirm the details. That way, if anything goes wrong, you’ve got a paper trail to back you up. Verbal assurances may feel good in the moment, but they won’t help you when it’s time to prove your case.

Ignoring the Impact of Your Actions

Sometimes, actions—or inactions—on your part can affect the outcome of a claim. For example, if you’re filing a car accident claim but didn’t file a police report, the insurance company might see that as a red flag.

Or, maybe you failed to keep your policy payments up to date, which could delay or even nullify your claim. It’s important to understand how your actions—or lack of them—affect the claims process.

Insurance companies can be unforgiving when it comes to missed payments or failing to follow basic protocol. If you’re serious about getting your claim processed quickly and successfully, stay on top of the details. The more proactive you are, the smoother the process will go.

Resources

How to File an Insurance Claim

https://www.consumerreports.org/cro/insurance

Common Insurance Claim Mistakes to Avoid

https://www.policygenius.com/insurance/insurance-claim-mistakes

Insurance Claim Process Explained

https://www.nationwide.com/lc/resources/insurance-claims

Frequently Asked Questions

What is the most common mistake people make when filing an insurance claim?

The biggest mistake is not reading the policy thoroughly. Many people misunderstand coverage or exclusions, leading to denied claims or delays.

Why is documentation important when filing an insurance claim?

Documentation provides proof of the incident, including photos, receipts, and witness statements, which strengthens your claim and prevents disputes.

How soon should I file an insurance claim after an incident?

File your claim as soon as possible. Most policies have strict deadlines, and late filing can result in claim denial or reduced payouts.

What happens if I misunderstand the claims process?

Not following the insurer’s process can cause delays or rejection. Always confirm the required steps, forms, and submission methods before filing.

Should I follow up after filing my insurance claim?

Yes. Regularly following up ensures your claim stays active and prevents it from being overlooked by the insurance company.

Can exaggerating or lying on a claim help me get more money?

No. Exaggerating or providing false information can lead to claim denial and even legal penalties. Always report the facts truthfully.

Why should all agreements be in writing during the claim process?

Written records create a paper trail that protects you. Verbal promises are unreliable, so confirm all details and updates in written form.

Kevin Collier is a legal expert passionate about simplifying complex legal concepts for everyday individuals. With a focus on providing clear, practical information, he covers a wide range of topics, including rights, responsibilities, and legal procedures. Kevin aims to empower readers with the knowledge they need to navigate the legal landscape confidently, ensuring they can make informed decisions regarding their legal matters. Through insightful articles and easy-to-understand resources, he helps demystify the law, making it accessible to all.